This is the second in a series of blogs on the UK Industrial Strategy Green Paper published recently by the UK Government. As we noted in Blog #1, the Green Paper marks a welcome change in the mood music around the adoption of a National Industrial Strategy.

This blog kicks off our detailed assessment, beginning with the final three questions posed in the Green Paper:

33. How could the analytical framework (e.g. identifying intermediate outcomes) for the Industrial Strategy be strengthened?

34. What are the key risks and assumptions we should embed in the logical model underpinning the Theory of Change?

35. How would you monitor and evaluate the Industrial Strategy, including metrics?

The Green Paper critically identifies the need for an overall analytical framework and mentions the Theory of Change which is a generic high-level approach which depends on explicitly defining the framework and associated logic, which is of course where the real challenge lies. Neo-classical economics does little to help in this regard: economists sometimes cite endogenous growth theory which only serves to highlight the gap in macro-economic thinking when it comes to modelling growth with sufficient granularity to drive practical policies. In particular, current approaches suffer from three major weaknesses:

- The conflation of industry sectors, products and technologies, which make it hard to understand and model the key drivers of change.

- A predominantly bi-polar view of growth, which emphasizes the importance of funding early-stage science and technology innovation followed by ‘scale-up’ funding for high-growth companies.

- The absence of a precise definition of commercialisation maturity, which is critical for monitoring and assessing the metrics of growth, including intermediate outcomes.

As argued by Mazzucato and Jacobs in Rethinking Capitalism; 'a much more dynamic and accurate understanding of how innovation occurs than is provided by orthodox economic theories' is required. Schumpeter & Stiglitz both recognised this same problem. A multi-polar approach is required, including intellectual property, talent and regulation, amongst others.

The most powerful response to this challenge to date has been provided by the Triple Chasm Model, which is based on a meso-economic model of growth underpinned by detailed data-driven analysis of the large number of variables which shape growth. The 7-year global research programme which led to the creation of the Triple Chasm Model started with a scoping exercise to understand and select the right metrics to define growth. This involved challenging the prevailing orthodoxy (largely based on funding) and identified several misperceptions in how current valuation metrics fall short. We will address this in more detail in Blog #5.

This model directly addresses the challenges posed by the three questions in the Green Paper, based on the following key building blocks:

- The Triple Chasm Model growth model is based on treating Product as the primary unit of analysis (concepts are treated as proto-products). Single product companies are then easy to assess based on product growth. Multi-product companies are addressed by defining product portfolios consisting of multiple products.

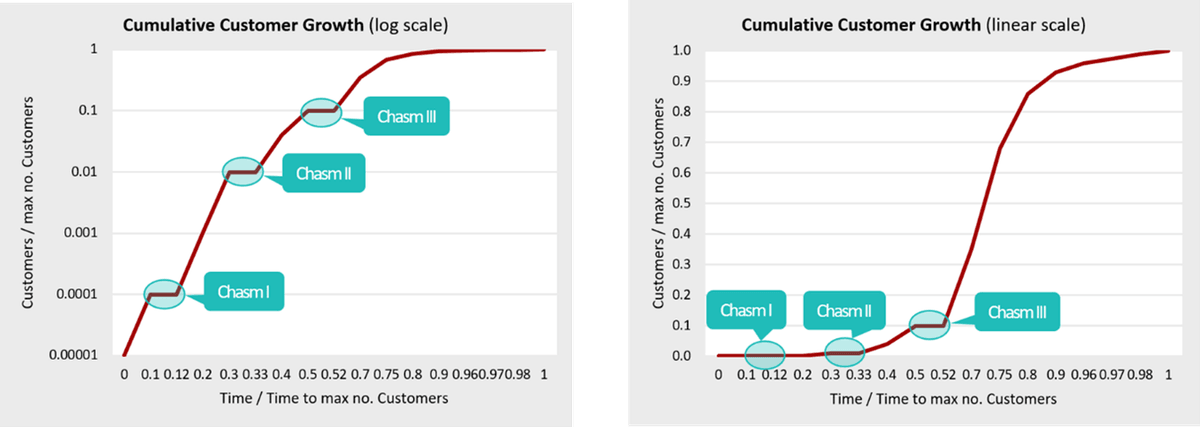

- The data underpinning the Triple Chasm Model confirmed that innovation-enabled growth is governed by the diffusion equation as postulated by Schumpeter but critically identified 3 key discontinuities or Chasms along the commercialisation pathway.

The Three Chasms

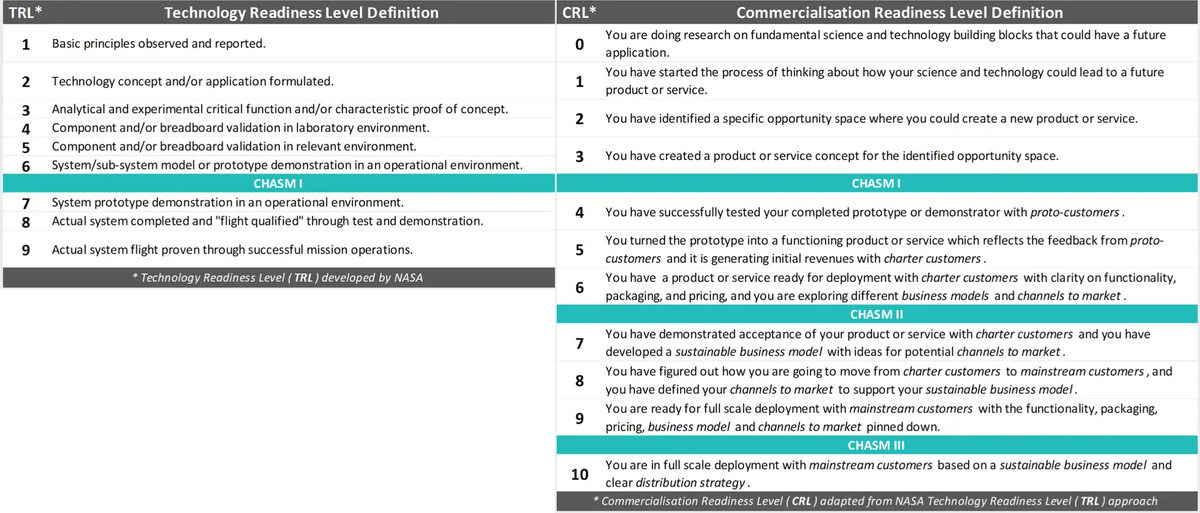

- Explicit definition of the Maturity of any proposition (product) is based on a new metric defined as Commercialisation Readiness Level (CRL) which incorporates the 3 Chasms but supersedes the more limited Technology Readiness Level (TRL) originally defined by NASA, which only addresses the earlier stages of growth.

CRL vs TRL

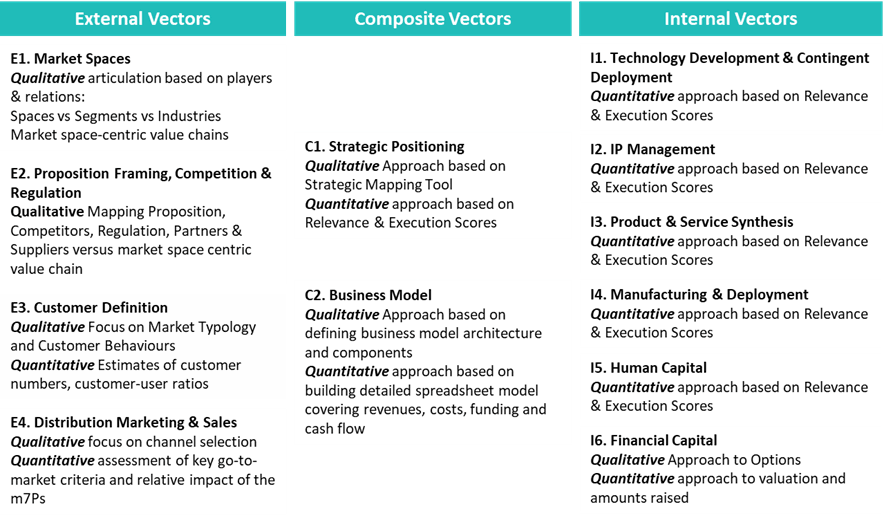

- Definition of a multi-polar view of the drivers of growth, based on 12 meso-economic Vectors derived from a crystallisation of over 170 growth variables.

- 4 'external' vectors which are typically outside the control of any single actor.

- 6 'internal' vectors which actors can typically control more actively.

- 2 composite or trade-off vectors, which determine the balance between 'market pull' and 'technology push'.

The 12 Vectors

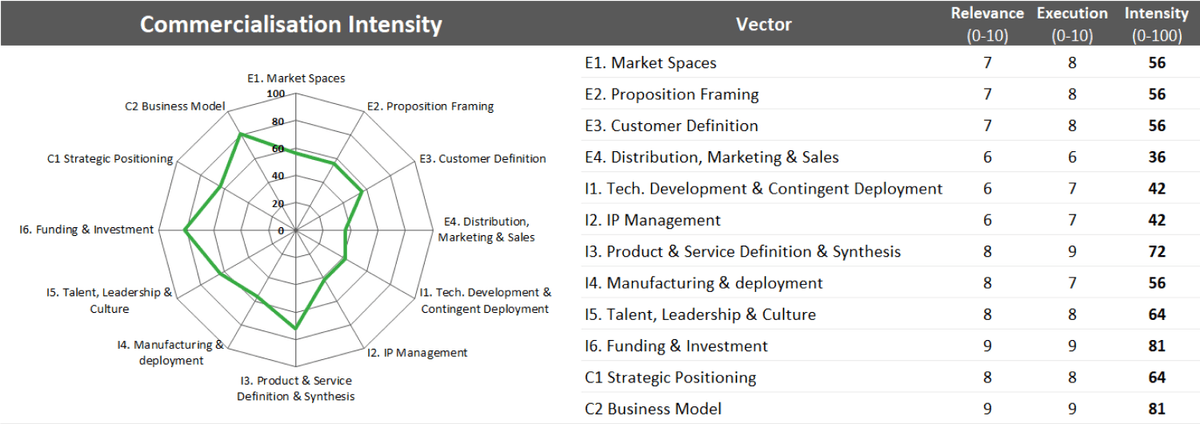

- Definition of a new ‘currency’ called ‘commercialisation intensity’ for measuring these ‘heterogeneous’ vectors, which allows the relative effect of the different variables to be quantified and compared.

Typical Profile of Commercialisation Intensity

This approach has already been successfully deployed in a wide range of interventions in the UK, continental Europe, North America, Asia, Africa and South America, with a wide range of ‘intervention agencies’ including investors, accelerators and eco-systems players.

A key issue is to understand and clarify the difference between input and output metrics: many of the metrics currently used to assess impact are in fact input metrics, such as the quantum of funding going into a venture, rather than the outputs of such interventions; the only reliable output metric in these conventional data sets is typically the number of new jobs created.

With this model we can build an integrated view of the growth journey based on combining CRL, the Vectors, and their quantification. It also provides us with a framework to monitor and evaluate changes over time, using Differential Impact metrics to assess the intermediate and final outcomes of any intervention. By taking periodic snapshots of products/services, it's possible to examine how they are developing in a manner far easier to interpret than conventional performance metrics.

Example of Differential Impact Framework

Taken together, the treatment of the 12 vectors in the Triple Chasm Model provides a powerful way to understand the growth challenges faced by companies in the UK, both in domestic and international markets.

Our treatment of the other questions in the Industrial Strategy Green Paper will reflect this powerful underlying framework which allows us to address the wide range of questions posed in the Paper: each set of responses will show how this framework can help to clarify the future shape of UK Industrial Strategy.